Alternatives to interest rates

Economic Policies, Recent Media Interview, The Australian Economy | 29th January 2024

Some weeks ago, the Australian Broadcasting Corporation (ABC)‘s Fiona Blackwood asked me to respond to a series of questions from listeners and viewers about possible alternatives to raising interestr ates as a way of tackling inflation. These were all very good questions, which deserved serious and thoughtful answers – which is what I hope I have provided here …

GIVEN ONLY ABOUT A THIRD OF AUSTRALIANS ARE MORTGAGE HOLDERS WHY DOESN’T THE GOVERNMENT USE SUPER CONTRIBUTION INCREASES OR COMPULSARY SAVINGS INSTEAD OF RAISING INTEREST RATES TO FIGHT INLFATION?

This actually sounds like quite a good idea, at least in principle. As the question indicates, varying the compulsory SGC rate would impact a broader spectrum of the population than is affected by interest rates – although, like interest rates, it would leave older people (who are, in general, richer than younger people) unscathed, since older people typically aren’t making contributions to superannuation.

But there are some practical problems – in particular, that changes in the SGC rate require legislation, which (a) takes time (in contrast to changes in interest rates), (b) may not get through the Parliament if the government of the day doesn’t have a majority in the Senate, and (c) requires politicians to accept and acknowledge responsibility for something that most people won’t like (in contrast to their being able to say that increases in interest rates are the responsibility of the independent central bank). It could also lead to calls for reductions in SGC contributions as a way of stimulating economic growth during economic downturns – which would undoubtedly be popular, but would in all likelihood be detrimental to most people’s longer-term interests.

It’s also worth bearing in mind that people with mortgages aren’t the only ones affected by increases in interest rates. Small businesses with borrowings are also affected (most small business loans are also at variable rates). Higher interest rates may encourage some people to save more (because the return to saving is higher) which by definition means spending less. Higher interest rates may reduce the value of assets (since asset values typically vary inversely with longer-term interest rates), which could in turn reduce people’s wealth (and hence, indirectly, their spending) even if they don’t have a mortgage. And interest rates can also affect the exchange rate between the Australian dollar and other countries (although there are other factors which also affect the exchange rate).

WOULD LIFTING THE GST WORK TO REDUCE INFLATION AND WOULD IT BE FAIRER?

Raising the GST would, in the first instance, add to inflation – although the Reserve Bank would presumably ‘look through’ that effect, as it did when the GST was introduced in 2000. Beyond that, it would probably work to reduce inflation in much the same way that higher interest rates do – that is, by reducing the spending capacity of households (though not of businesses) – provided that the initial increase in ‘headline’ inflation triggered by an increase in GST didn’t result in additional wage increases. And it would affect a broader spectrum of the population than is affected by increases in interest rates. In that sense, an increase in the GST may seem fairer than increasing interest rates.

But that doesn’t mean it would be ‘fair’. An increase in the GST would have its greatest impact on low-income households, since they spend a higher proportion of their incomes than middle- and high-income households: whereas most low-income households don’t have mortgages, so they’re not affected at all (at least, not directly) by increases in interest rates.

And there are some additional practical problems with using the GST as an alternative to interest rates.

First, like changes to SGC contribution rates, it would require legislation – which takes time (unlike increases in interest rates), and in any case may not pass through the Senate.

Additionally, under the terms of the Inter-governmental Agreement which established the GST it would require the approval of every state and territory parliament – something which would take even more time and which in any event might not be forthcoming.

Third, it would (as with increases in superannuation contributions as an alternative to interest rates) require politicians to accept and acknowledge responsibility for making a lot of people worse off, rather than being able to point to the ‘independent central bank’. In particular, it would require the Federal Government to wear the political odium for raising the GST – but the states and territories get the political kudos for spending the resulting additional revenue – which is unlikely to be appealing to any Federal Government.

A ‘fairer’ alternative to raising interest rates than raising the GST might be to raise income tax – since the personal income tax system is ‘progressive’, that is, it imposes a proportionately greater burden on higher income households than lower income ones.

Indeed, this was the more common way of responding to high inflation in the 1950s and 1960s. In 1951, in response to the double-digit inflation triggered by the Korean War wool boom, the Menzies Government imposed a 10% surcharge on personal income tax, increases in company tax rates, a requirement that companies pay 10% of their estimated tax liabilities in advance, and an increase in the rate of sales tax from 8½% to 12½%. Menzies had previously ruled out raising interest rates out of a reluctance to impose capital losses on people who had bought war bonds, while Treasurer Arthur Fadden ruled out allowing the Australian pound (as it then was) to appreciate – which would have been the obvious (and most effective) thing to do to counter the inflationary pressure engendered by the sharp rise in the price of what was then Australia’s principal export – because he was also leader of the Country Party (the forerunner of today’s National Party) which was always opposed to a revaluation of the currency, no matter how justified (since it would be detrimental to farmers).

These measures ‘worked’ – inflation fell from a peak of 23.9% over the year to the December quarter 1951 (the highest ever recorded in Australia) to a low of 1.6% two years later – but at the price of sending Australia into its first post-war recession (real GDP shrank by 0.8% in 1952-53, which represented a drop in real per capita GDP of 2.8%), and pushing the unemployment rate up from 1.1% to 2.9%, a figure considered extremely high in those days. The Menzies Government’s response was “too much too late” – and that was partly because it waited until after the election held in April 1951 before doing anything about inflation, even though it had already reached 12% by the end of 1950. This illustrates the risks involved in relying on measures which require political decisions and legislative action to deal with inflation.

The Holt, Gorton and McMahon Governments used smaller increases in personal and company income taxes and sales taxes in their attempts to contain inflationary pressures in the second half of the 1960s and early 1970s, but these were again mis-timed. The 1971 Budget included a 5% surcharge on personal income tax, and increases in a wide range of sales taxes – which sent the economy into recession (the unemployment rate rose from 1.7% in the March quarter of 1971 to a peak of 3.0% in the September quarter of 1972) but didn’t do much to curb inflation (which having peaked at 7.1% in the September quarter of 1971 was still running at close to 5% by the time the Coalition Government lost office at the election of December 1972).

Returning to the present day, it could perhaps be argued that an alternative to raising interest rates might be to abandon or delay the third tranche of the Morrison Government’s tax cuts due to come into effect in July 2024.

There certainly are arguments for considering that, including that those tax cuts favour high-income earners, and come at a significant medium-to-longer term cost to the budget at a time when the budget is projected to be in significant and persistent structural deficit. But the key point in this context is that those tax cuts don’t come into effect until July 2024: so cancelling or deferring them isn’t, and wouldn’t have been, a substitute for raising interest rates over the past 18 months.

ARE INTEREST RATE RISES COUNTERPRODUCTIVE IN TAMING INFLATION, AS THEY PUSH UP RENTS AND INCREASE SPENDING POWER FOR THOSE WHO ARE MORTGAGE FREE?

The historical evidence – from Australia and other countries – indicates, I think quite unequivocally, that tighter monetary policy (that is to say, higher interest rates) will ultimately be effective in taming inflation. Indeed it’s difficult to think of many examples in the past, say, 50 years – and I can’t think of any in Australia – where unacceptably high inflation (say, of more than 5%) hasn’t been brought down to acceptable levels without higher interest rates.

The question is perhaps more, what are the other consequences – in particular, for employment – of using interest rates to ‘tame’ inflation. If central banks make mistakes – for example, by raising interest rates ‘too much’, or (more pertinently in the current context) waiting ‘too long’ before starting to raise them so that inflation gets a ‘head start’ – then there usually will be a high price paid by those who lose their jobs, or having entered or re-entered the labour force are unable to find a job.

Of course it’s much easier to say in retrospect that a central bank has kept rates ‘too high’ (or ‘too low’) for ‘too long’ than it is to get those judgements right in ‘real time’ with imperfect and incomplete information.

Nonetheless I think there are reasonable prospects that Australia (and probably the US and Canada, though I’m not so sure about the euro area, the UK or New Zealand) will be able to get inflation back down to ‘acceptable’ levels (which in Australia means between 2 and 3%) without precipitating a recession. Yes, the unemployment rate will rise some more as growth in aggregate spending slows (as it has to, if inflation is to be brought back to ‘acceptable’ levels): but that will largely be the result of people entering the labour force (migrants and those completing their formal education) take longer to find jobs, rather than from people losing jobs.

I would dispute that interest rates push up rents. Rents are of course rising – and making a significant contribution to the persistence of unacceptably high inflation – but that owes far more to rapid growth in the demand for rental housing, fuelled in particular by the surge in immigration (especially of students and temporary workers, who for obvious reasons are overwhelmingly renters) and sluggish growth in the supply of rental housing.

Renting isn’t, in my view, a ‘cost-plus’ business. Landlords charge what the market will bear: if vacancy rates are low, as they are at present, they will try to, and will usually be able to, put rents up, irrespective of whether interest rates, council rates or any other of their costs are rising. Conversely if vacancy rates are high, they won’t be able to raise rents very much (or at all), irrespective of what’s happening to their costs.

It is of course true that rising interest rates increase the spending power of those who are mortgage-free – not all of whom are rich, incidentally: a lot of them are pensioners, and some of them are young adults trying to save up for a deposit on their first home (both groups are usually forgotten about when interest rates are going down).

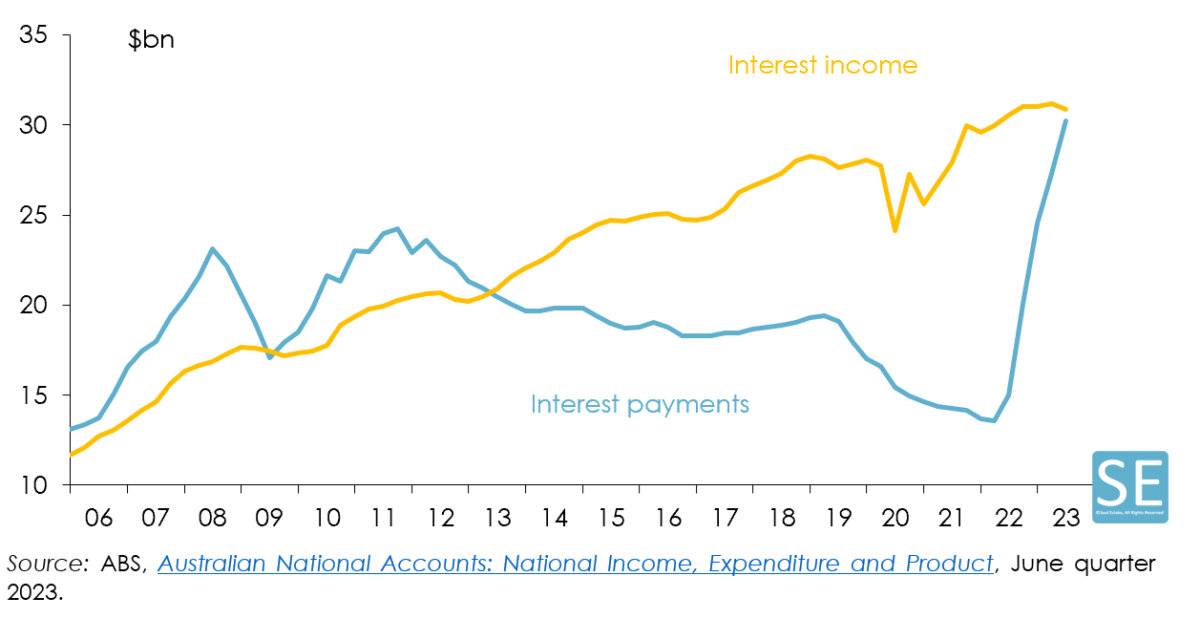

But interest payments have (in aggregate) increased a lot more than interest income, as shown in the chart below (which only goes up to the June quarter of this year).

Almost certainly, the household sector became a net payer of interest (for the first time in 10 years) in the September quarter (we’ll find out when the September quarter national accounts are released on 6th December).

So higher interest rates will definitely have a dampening impact on household spending – as they are meant to – and I expect this will become more obvious in 2024.

Household interest payments and income

Source: ABS, Australian National Accounts: National Income, Expenditure and Product, June quarter 2023.

IS THERE ANY APPETITE OR LIKELIHOOD OF CHANGING THE WAY INFLATION IS MANAGED SO IT’S LESS OF A BURDEN ON MORTGAGE HOLDERS?

I think I’ve covered this in my answers to the earlier questions about using increases in superannuation contributions, or in the GST, as alternatives to interest rates as a means of controlling inflation.

To recap, increases in SGC contributions and/or increases in personal income tax could be used as alternative ways of reducing aggregate household spending and hence bringing inflation down to ‘acceptable’ levels: and indeed in the 1950s, 60s and early 70s, variations in personal income, company income and sales taxes were used (in preference to changes in interest rates) as means of restraining growth in aggregate spending in order to control inflation or of boosting growth in aggregate spending in response to downturns in economic activity and increases in unemployment.

Arguably these are ‘fairer’ in that they impact (directly) a broader spectrum of the population than increases in interest rates.

But they do take longer to implement, because they require legislation to be passed by Parliament, and these days Governments typically don’t have majorities in both houses of Parliament which would guarantee that the necessary legislation would be passed (and passed quickly) by the Parliament – whereas increases in interest rates can be implemented almost instantaneously. (They can be reversed almost instantaneously as well, when they’re no longer required, whereas measures requiring legislation to implement also typically require legislation to unwind – raising the risk that an increase in SGC contributions or personal income tax could be left in place for ‘too long’, increasing the risk of an unwarranted economic downturn).

The other problem with measures requiring legislation is that, of necessity, they require politicians to accept and acknowledge responsibility for decisions that will make a lot of people worse off – and that’s something that politicians are far less willing to do these days than they were in days of yore. It’s much easier for politicians to shift the ‘blame’ for the pain required to bring inflation under control to the ‘independent central bank’. Fortunately, the independent central bank is prepared to accept that responsibility.

GIVEN THE PAIN MANY AUSTRALIANS ARE GOING THROUGH AND GIVEN THE EXTRA PROFIT BANKS ARE MAKING FROM RISING INTEREST RATES – SHOULD THE GOVERNMENT INCREASE TAXES ON BANKS SO AUSTRALIANS AS A WHOLE CAN SEE SOME BENEFIT FROM THEIR FINANCIAL STRESS?

Australian banks are certainly very profitable. In their most recent annual financial reporting period, the four big banks made pre-tax profits totalling $45.3 billion. That’s a lot of money. One of the reasons it is a big number is because the banks are very big, with assets totalling $4,441 billion at the end of their latest reporting periods. So $45.3 billion in pre-tax profits represents a return on those assets of 1.02% – which is not a very big number at all.

Out of that $45.3 billion in pre-tax profits, the four big banks paid income tax totalling $13.4 billion. That represents an effective tax rate of 29.3% – which is pretty close to the statutory company tax rate of 30%, something which can’t be said of many of Australia’s other highly profitable large businesses. In addition to company income tax, the four large banks together with Macquarie Bank pay $1.6 billion each financial year in the form of the ‘major bank levy’ initially introduced by the Morrison Government – which is in effect a ‘special tax’ levied only on those five banks.

The four big banks also employ almost 163,000 people, so they would have paid a lot of payroll tax to state and territory governments. And they would also have paid a lot of GST – for which, unlike other businesses, they don’t get a refund, since GST isn’t charged on financial services.

While the banks obviously benefit from higher interest rates on loans when interest rates go up, they also have to pay higher interest rates on deposits, and on the borrowings they undertake in the capital markets, which they use to fund those loans.

In fact, data collected and published by the Reserve Bank indicates that average interest rates on deposits have risen by more than average interest rates on mortgages since the RBA began lifting its official cash rate in May 2022.

It’s also worth remembering that the Reserve Bank has been lifting interest rates since May 2022 with the specific and explicit intention of slowing the rate of growth in aggregate spending (by households and businesses) in order to bring it more into line with aggregate supply, so as to make it more difficult for businesses to raise prices (whether to recoup increases in their costs, or to boost their profit margins).

If by some chance the banks were to have absorbed one or more of the increases in the RBA’s cash rate into their profit margins rather than passing it on to their borrowing customers, thus thwarting the RBA’s intention in raising the cash rate, the result would be that the RBA would end up raising the cash rate by more than otherwise.

So, whatever ‘warm inner glow’ calling for higher taxes on banks might generate, the case for actually doing so isn’t especially compelling, in my view, and it wouldn’t make any difference whatsoever to the pain being felt by those with mortgages.

WHAT ABOUT THE BIG COMPANIES DRIVING INFLATION WITH AGGRESSIVE PRICE INCREASES – CAN THAT BE IN ANY WAY CONTROLLED?

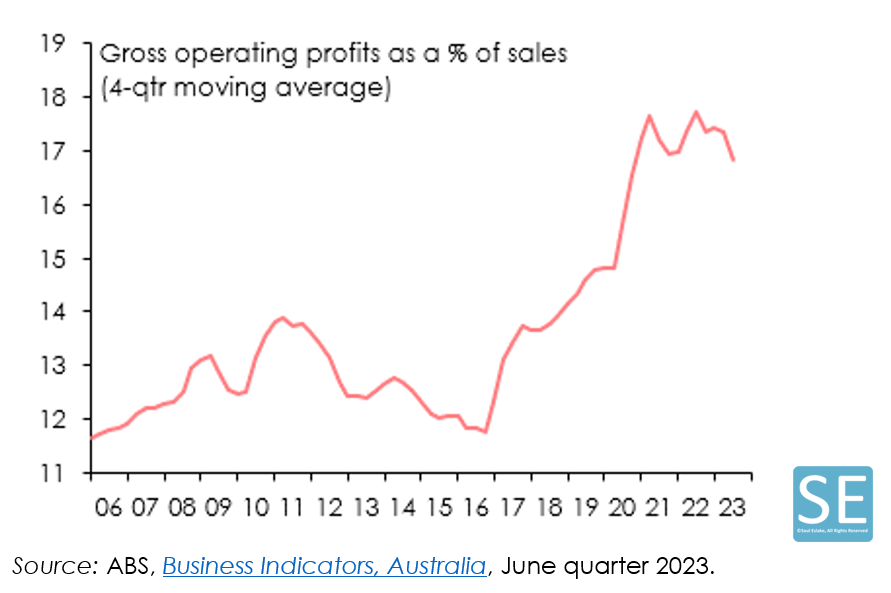

At first glance there would appear to be some substance to the assertion that ‘profiteering’ by companies has contributed to the re-emergence and persistence of inflation over the past two years. Corporate profit margins have risen significantly over the past six years, as shown in the following chart:

Companies’ gross operating profit margins

Source: ABS, Business Indicators, Australia, June quarter 2023.

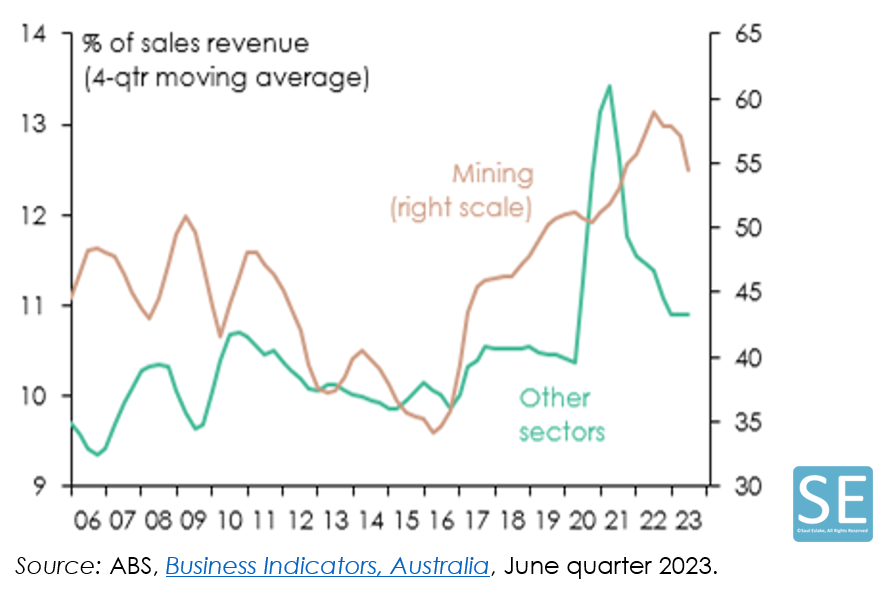

But closer inspection of this data shows that the increase in profit margins has been almost entirely attributable to the mining sector:

Companies’ gross operating profit margins – mining and other

Source: ABS, Business Indicators, Australia, June quarter 2023.

The increase in mining company profits and profit margins since 2021 has been largely driven by increases in the prices of commodities produced by Australia’s mining sector, such as coal and iron ore – which are not in the consumer price index – and gas, the retail price of which is in the CPI (albeit with a relatively small weighting). Moreover, most of the output of the mining sector is exported – so the higher prices for these commodities are being paid by foreigners, not by Australians. And those higher mining company profits are generating substantially larger company tax payments (like the big banks, Australia’s two largest mining companies, BHP and Rio Tinto, pay close to the statutory 30% tax rate on their profits) which have in turn helped push the federal budget back into surplus, allowing the Government more readily to fund ‘cost of living relief’ to households in the form of assistance with (for example) electricity bills and child care costs.

By contrast, non-mining company profit margins – which did rise during the pandemic – have fallen during the period in which inflation has been rising, and so can’t have been a significant contributor to the rise in inflation since then. There are some specific instances where companies have increased their prices significantly in order to boost their profits – most obviously the airlines – but they’re the exception, rather than the rule.

It’s also perhaps worth noting that the Federal Government doesn’t have the constitutional power to regulate prices – and that the Australian people have twice (in 1948 and 1973) rejected referendum proposals that it should be given such powers.

WHAT ABOUT THINGS LIKE RISING COSTS OF PETROL PRICES AND ELECTRICITY THAT ARE CONTRIBUTING TO INFLATION – IS IT FAIR TO SAY LIFTING INTEREST RATES WON’T MAKE A DIFFERENCE WHEN IT COMES TO MANAGING THEIR IMPACT AND IS THERE A BETTER WAY?

It’s true that higher interest rates won’t have any direct impact on the price of petrol or electricity. The former depends largely on the price of crude oil (which is set in global markets) and the value of the A$ against the US$ (which can be influenced by Australian interest rates to the extent that they diverge from US interest rates); while the latter depend on the prices of inputs to electricity generation, which in most states is still largely a combination of coal and gas (whose prices are determined globally) even though renewables are becoming more important), and the costs of transmission and distribution of electricity (with transmission costs rising in order to fund the investment required to connect up renewables).

But the RBA isn’t raising interest rates in order to influence the prices of petrol or electricity, or indeed any individual price.

Rather, recognizing that inflation – a sustained increase in the prices of a broad range of goods and services – is the result of aggregate (or total) demand for goods and services exceeding the aggregate supply of goods and services, and also recognizing that there is nothing it can do about aggregate supply, the Reserve Bank, like its counterparts in almost every other developed economy and many developing economies, is seeking to slow the rate of growth in aggregate demand to something more closely aligned to aggregate supply.

It does this by increasing the cost of borrowing, and increasing the reward for saving, in the expectation (justified by history) that this will reduce the rate of growth in spending.

There are, as my answers to other questions in this series indicate, other ways of achieving the same objective – such as, most obviously, raising taxes rather than interest rates. But that requires legislation, which takes time to prepare, and which in any event might not get through Parliament: whereas changing interest rates can be done almost instantaneously and without requiring Parliamentary sanction. It also absolves governments of having to accept any political responsibility for the financial pressure being placed on those adversely affected by higher interest rates: “don’t blame us, it’s the independent central bank”.

WHY DOESN’T THE RBA LIFT THE INFLATION TARGET TO 5 OR 6 PERCENT WHILE GLOBAL FORCES ARE AT PLAY AND TAKE THE PRESSURE OF MORTGAGE HOLDERS?

While global factors – in particular, the surge in energy and some food commodity prices triggered by Russia’s invasion of Ukraine, and disruptions to global supply chains caused by Covid, escalating tensions with China, etc. – played a role in the initial rise in inflation in the first half of 2022 – they weren’t the only factor, and they’re certainly not the major factor driving inflation in 2023. Rather, most of the inflation being experienced in Australia, as in other economies is ‘home grown’, the result of growth in aggregate demand for goods and services persistently exceeding aggregate supply.

One reason for that, in Australia and in most other ‘advanced’ economies, is that the stimulatory fiscal and monetary policies put in place at the onset of the Covid pandemic in 2020 were left in place for too long – long after it had become obvious that the economic damage wrought by Covid, serious though it was, was nowhere near as large nor as persistent as had been initially feared.

The rationale behind giving central banks an inflation target (and the operational freedom from political interference to use monetary policy to attain it) is to give people (consumers, workers, and business owners and managers) confidence that inflation will remain ‘low and stable’, so that they can then in turn make decisions about spending and saving, investment and employment, etc. without being distorted by the need to protect themselves from the damage caused by high and volatile inflation.

That ‘damage’ can include the erosion in the real value of savings (in particular, retirement savings); being pushed into higher income tax brackets even though your real income hasn’t risen; being unable to identify significant changes in relative prices (which in a properly-functioning market economy are an important mechanism for signalling changes in patterns of demand or sources of supply); and arbitrary redistributions of income and wealth from people who are unable to shield themselves from high inflation to those who can (with the latter usually being richer than the former).

The selection of a particular inflation target usually involves a ‘trade-off’ between the advantages of low inflation, and the costs which may be involved in achieving it (in particular, higher unemployment). Most developed economies have an inflation target which is either 2% (as in the US, the euro area, the UK, Norway, Sweden and Japan) or a range around 2%, most commonly 1-3% (as in Canada and NZ). Australia’s target of 2-3% “on average over the course of the business cycle” is thus a little bit softer than that of most other comparable countries.

There’s not much point in having a target if you change it whenever it looks like being difficult to achieve. Indeed, if people were to come to expect, based on experience, that whenever inflation was a long way away from whatever the target was, it would be the target that was changed rather than monetary policy settings, the target would cease to be of any value whatsoever.

History also teaches that if people come to expect a high rate of inflation, they will behave in ways that make it far more likely that inflation will remain high (and, probably, volatile and hence unpredictable as well).

Thus for example businesses will put up prices not only to recoup cost increases which have occurred, but also to cover cost increases which they expect will occur in the not-too-distant future. Likewise workers and their unions will seek pay rises to ‘compensate’ them not only for the price increases that have occurred since their last wage or salary adjustment, but also to compensate them for price increases which they expect to occur in the period ahead: and to the extent that they’re successful in that, they will have validated the aforementioned expectations on the part of businesses.

This is what happened in the 1970s and 1980s, and it took deep and protracted recessions to bring inflation back down to tolerable levels – something which, thankfully, doesn’t seem likely in the current cycle.

HOW MUCH OF AUSTRALIA’S INFLATION PROBLEM IS A RESULT OF THE BILLIONS OF DOLLARS IN COVID PAYOUTS?

As I noted in my response to the previous question, most of the inflation now being experienced in Australia, as in other economies, is the result of growth in aggregate demand for goods and services persistently exceeding aggregate supply. One reason for that, in Australia and in most other ‘advanced’ economies, is that the stimulatory fiscal and monetary policies put in place at the onset of the Covid pandemic in 2020 were left in place for too long – long after it had become obvious that the economic damage wrought by Covid, serious though it was, was nowhere near as large nor as persistent as had been initially feared.

In Australia’s case, both the Federal and state governments threw (as the question notes) “billions of dollars” at households, whilst simultaneously coming up with ways of preventing them from spending those billions (protracted lockdowns and closures of interstate and international borders). As a result, savings mushroomed: according to the ABS national accounts, Australian households saved almost $401billion between the June quarter of 2020 and the March quarter of 2022, a period of two years – more than they had saved over the preceding seven years. APRA figures indicate that household bank deposits increased by more than $270 billion over the two years to March 2022. While those savings obviously weren’t uniformly distributed across households, in aggregate households have been able to reduce saving, or draw down those earlier savings, in order to cushion the impact of higher interest rates, higher taxes and falling real incomes on the level of household spending.

The other factor was of course that interest rates were kept ‘too low for too long’, stimulating demand for longer than was necessary, and rekindling property price inflation. Every developed economy central bank made that mistake – which is of course easier to spot with the benefit of hindsight than it was at the time.

But Australia left interest rate ‘too low’ for longer than most other developed economies. The Bank of Korea was the first advanced economy central bank to start withdrawing monetary policy stimulus by raising interest rates in August 2021; Norges Bank (Norway’s central bank) started increasing interest rates in September 2021; the Reserve Bank of New Zealand raised its cash rate for the first time in October 2021; the Bank of England started raising interest rates in December 2021; Sweden’s Rijksbank in February 2022; and the US Federal Reserve and the Bank of Canada in March 2022.

By contrast, the Reserve Bank of Australia was still foreshadowing up until November 2021that its cash rate would most likely remain at its Covid-induced low of 0.10% until 2024; and even though Australia’s underlying inflation rate was back inside the target range by the September quarter of 2021 (according to data released on 27th October of that year), as late as March 2022 the RBA was still insisting that it was “too early to conclude that it [inflation] was sustainably within the target range”, and that it wouldn’t increase the cash rate until it was. Two months later, it was.