Economists’ view of the world – rates, growth and trade wars

Publications, The Global Economy | 15th August 2018

Reflections on the views of current and former bank chief economists from around the world at this year’s International Conference of Commercial Bank Economists, and on the possible consequences of a ‘trade war’ – article published by FIIG’s The Wire on 15th August 2018

Last month, esteemed economist Saul Eslake attended a gathering of about 25 current and former bank chief economists from around the world. Read about their consensus views and the potential damage of an all out trade war

Last month I attended, as I usually do in July each year, a gathering of about 25 current and former chief economists of banks from every inhabited continent around the world. It’s a conference which was first held in 1937, and has been held annually since 1969. Participants spend four days reviewing economic conditions in all of the world’s major regions, and discussing some of the key issues confronting economic policy-makers, financial institutions and market participants over the past year and in the year ahead.For the most part, the economists attending this year’s conference (which was held in New York) expected growth in the world’s major economies to be only slightly slower next year than this year (in which global growth will be faster than in any year since 2010), inflation to increase a little, and interest rates to go up gradually.On average, the economists attending the conference expected the US Fed funds rate (currently 1¾-2%) to reach 3% by the end of next year, and to be 3-3¼% by the end of 2020; while they expected the European Central Bank’s deposit facility rate (currently -0.4%) to have become marginally positive by the end of next year, and to be at just under 0.5% by the end of 2020.Most of the economists expected the US 10-year Treasury bond yield to continue drifting higher over the next 12 months, with the median forecast being 3¼% and five (of whom I was one) anticipating that it could reach 3¾% by the middle of next year. Only five forecasts for the 10-year bond yield had a ‘2’ handle on them.

By far the greatest concern among the economists attending this year’s conference was rising protectionism, particularly as a result of the ‘trade war’ unleashed by the Trump Administration.

Asked to list ‘the three greatest threats to the global economy over the next three years’, 22 of the 25 nominated ‘protectionism’; the next most-commonly cited concerns were ‘populism’, ‘geopolitics’, a ‘monetary policy mistake’, and ‘market volatility’, none of which garnered more than seven mentions. Asked specifically how serious a risk ‘protectionism’ was, 22 said ‘significant’ and the other three said ‘moderate’.

Some might say that such a perspective is unduly alarmist. After all, it could be argued, so far the US Administration has imposed (or foreshadowed) increased tariffs on imports worth about USD88bn annually (USD38bn of imports of steel and aluminium, and USD50bn of imports from China). That’s about 3½% of total US imports, or just under ½% of US GDP annually. Add in the retaliatory measures undertaken by other countries (mainly China, the European Union and Canada), and we’re talking about 0.4% of total world trade, or about 0.2% of world GDP.

However, the Trump Administration seems unlikely to stop at this point. It has threatened to impose tariffs of up to 25% on a further USD200bn of imports from China in response to what it calls China’s ‘illegal retaliation’ against the first tranche of tariff increases – which illustrates the potential for a rapid escalation of the ‘trade war’ now under way between the world’s two largest economies. And, separately, it has foreshadowed a 20% tariff on imports of motor vehicles and parts (worth almost USD200bn in 2017), on ‘national security’ grounds – which illustrates the way in which ‘security’ can be used as cover for otherwise indefensible policies, including in the area of trade.

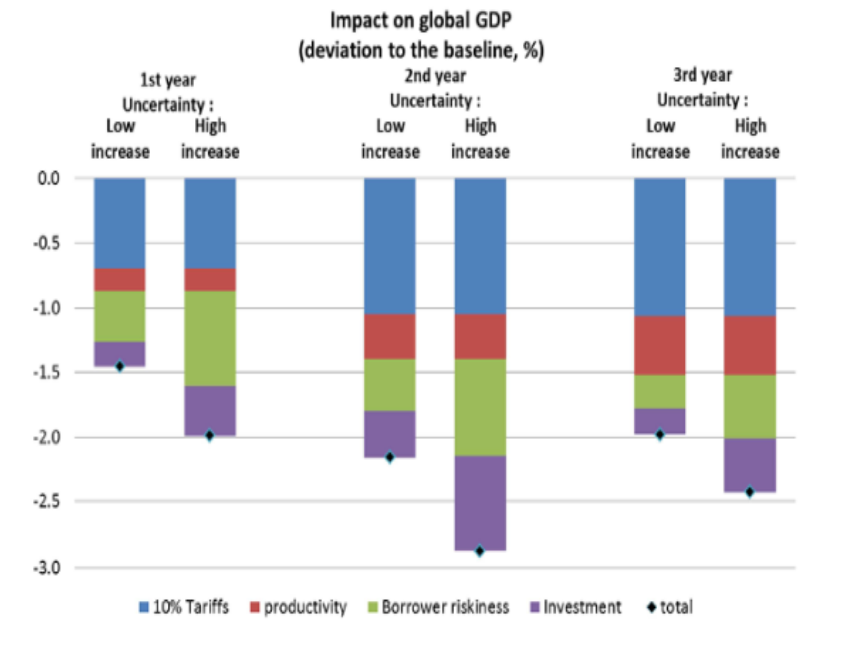

Moreover, looking narrowly at the volume of trade, subject to tariffs, misses some of the ways in which trade-restricting measures adversely affect economic activity. A study by economists at the Banque de France (France’s central bank) suggests that the economic losses arising from lower productivity (because imports will replace goods produced less efficiently and at higher prices by domestic firms), increased costs of capital, and lower levels of business investment (both as a result of increased risk and uncertainty) could exceed the direct losses attributable to increased tariffs (see chart).

Chart 1: Impact of tariff increases on global GDP

Source: Banque de France, 19th July 2018.

Prominent US economist and commentator Paul Krugman, who won the 2008 Nobel Prize in Economics for his work on international trade, calculates that a ‘serious’ trade war – one in which tariffs escalated into the 30-60% range – could lead to a 70% reduction in world trade, resulting in turn in a 2-3% decline in world GDP. That’s not as bad as the downturn induced by the global financial crisis a decade ago, but it’s still pretty serious.

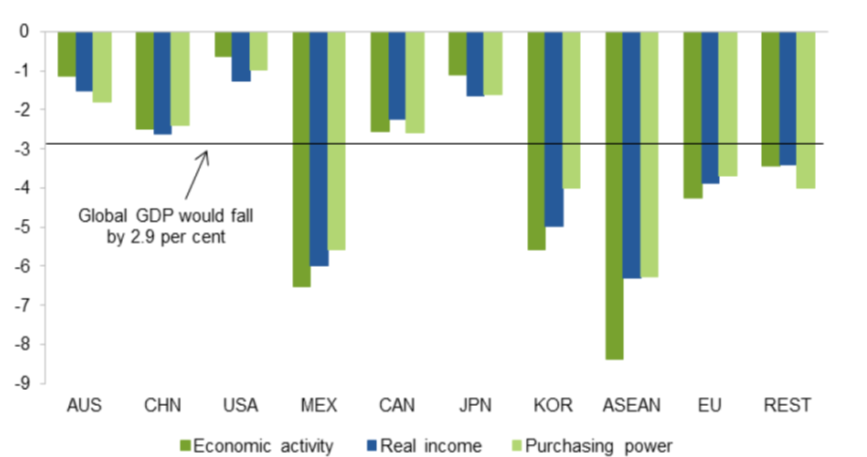

Australia’s Productivity Commission, in a research paper published in July last year, suggests that an all-out ‘trade war’ would do less damage to the Australian economy than to many others.

That’s partly because, for all that we tell ourselves that we are a great ‘trading nation’, exports account for only about 22% of Australia’s GDP – a smaller proportion than for almost any other major economies apart from the US, Japan and India.

In addition, Australia’s mineral and energy exports (which account for about 45% of the total) are less likely to be subjected to other countries’ tariffs, because of their importance as inputs into other countries’ production processes.

Nonetheless, the Productivity Commission suggests that, in a scenario in which world-wide tariffs increased by an average of 15 percentage points (that is, rather less than the one envisaged by Paul Krugman), the value of Australia’s exports would fall by 15%, our GDP by about 1%, the ‘purchasing power’ of our national income by closer to 2%, and employment by about 100,000 (see Chart 2).

Chart 2: Impact of world wide 15 pc tariff increase on Australia and other countries

Source: Productivity Commission, July 2017

So economists are right to be concerned about the possibility of a ‘trade war’, particularly given the seriousness with which the Trump Administration appears to be pursuing one, and its apparent lack of understanding of (or disregard for) its consequences.

What’s more difficult to figure out is the likely consequences of a ‘trade war’ for interest rates. Since tariffs ‘work’ by raising prices, a ‘trade war’ is likely to lead, at least initially, to higher inflation – something which is already apparent in measures of ‘upstream’ inflation in the United States. In theory, should be reflected in higher market interest rates. And to the extent that central banks expected that the initial inflationary impact of increases in tariffs would be passed through into higher inflation more generally, they would likely bring forward or accelerate the increases in policy interest rates that they would have been contemplating in the absence of a ‘trade war’.

But central banks, and market participants, would no doubt also be mindful of the likely consequences of an all-out ‘trade war’ for economic activity, as sketched out in some of the modelling exercises referred to earlier. Hence, over the longer term, interest rates could well end up being lower as a result of a trade war than under a ‘business as usual’ scenario.

Perhaps the key point is that uncertainty over the direction of interest rates is simply yet another reason why, contrary to what President Trump appears to believe, there really are no ‘winners’ in a ‘trade war’.

Saul Eslake is an independent economist, speaker, company director and Vice-Chancellor’s Fellow at the University of Tasmania.