OLIVER FRANKEL. Saul Eslake’s well timed warnings help inform the housing affordability debate

Housing, News | 29th March 2017

Oliver Frankel | Pearls and Irritations | 29th March 2017

As published on John Menadue’s Blog – Pearls and Irritations.

John Menadue is a former head of the Departments of Immigration, Trade and Prime Minister & Cabinet, and also a former CEO of Qantas.

In a report entitled No place like home – The impact of declining home ownership on retirement, commissioned by the Australian Institute of Superannuation Trustees (AIST), Eslake points to some fairly startling statistics lying beneath the broad numbers.

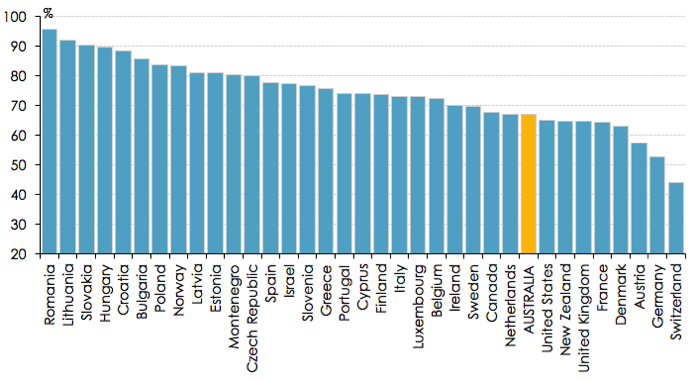

Even the broad numbers show that our rate of home ownership is not particularly high by international standards, despite the long talked about Australian dream. The following chart from the AIST report illustrates the point.

Source: Reserve Bank of Australia (2015).

Although overall home ownership in Australia fell by “only” 4% over the period from 1995-96 to 2013-14, the fall amongst all age groups other than the over 55s was much greater. For example, it was more than 3 times greater (13.5%) for those aged 25-34. Even in the 45-54 age group, it was twice as large (8.1%).

The AIST report warns that these trends have some disturbing implications for Australia’s retirement income system, which implicitly assumes that the vast majority of retirees will have very low housing costs. He demonstrates that this assumption is becoming less valid over time.

The AIST report reveals a material deterioration in the degree to which mortgage debt is paid off. Overall mortgage free home ownership declined from 61.7% in 1995-96 to 46.7% in 2013-14.

The changes for some age groups are even more startling. For example, there was a near tripling between 1995-96 and 2013-14 in the proportion of 55-64 year old homeowners with outstanding mortgage debt, and for those aged 65 and over the proportion rose by 2 ½ times.

The report also paints a much more nuanced picture of the trend towards renting than would appear from just looking at overall numbers. Despite the apparently minor increase in total numbers of people renting – up by only 2% (to 31%) between 1995-96 and 2013-14 – the changes are much greater for some age groups.

The increase over that period in the proportion of renters aged 25-34 was 6 times larger (at 12%) than the overall figure of 2%. Not much less startling were the increases for older cohorts: 4 times larger for those aged 35-44 and 3 times larger for those aged 45-54.

The AIST report also points to the diminishing role of public housing in the rental housing market, with adverse consequences for lower income renters in terms of rental affordability (as well as security of tenure). This reflects, at least in part, the decline since around 2001 in social housing as a proportion of overall housing stock.

Quite apart from the increased housing stress for those affected by these falls in home ownership and rise in mortgage debt, they will also put more pressure on public finances, particularly the age pension and Commonwealth rental assistance.

While the AIST report clearly accepts the need for more housing supply – something that government already acknowledges – it makes a strong case for demand side initiatives, including reforming negative gearing and the overly generous CGT discount.

Eslake opposes cash grants and stamp duty concessions for first home buyers, which he says have the effect of artificially inflating demand for housing. He also stomps on the idea of allowing such buyers to tap into their superannuation savings to assist in raising a deposit.

The AIST report ends with a range of specific suggestions as to how the Commonwealth and State governments could improve home ownership rates and help ensure that those who do own their homes are mortgage debt free in retirement.

With the Federal Budget only some 6 weeks away, the AIST report and Eslake’s insights are not only well aimed but also well timed.

[Saul Eslake is one of the experts who will be contributing to P&I’s upcoming blog series focused on a range of topics concerned with housing affordability, due to be published from 1 May, in the lead up to the Federal Budget. P&I has in recent months featured many blog posts concerning housing affordability. ]

Oliver Frankel is a former corporate finance and M&A lawyer, who has spent the second half of his career in finance, investment and management. Most recently, he has taken a strong interest in how to address the affordable housing crisis.